"Nobody here pays the sticker price": Tuition Discounting and College Costs

All about the Kohl's Cash of higher education

Several years ago, I had a conversation with a college president from a small private liberal arts college in the Midwest. I was interviewing several presidents as part of some grad school research focused on college access and affordability and was delighted at how open they were about the challenges and the joys of leading colleges and universities. I was also occasionally surprised at how forthcoming they were about the financial realities of enrollment management (college speak for “enough butts in seats to pay our bills”) .

During our conversation about affordability, he mentioned that his college had briefly considered doing a tuition reset and lowering their tuition cost by about $5000 to $8000 dollars, with the goal of attracting more students and staying competitive in a tight enrollment market. They decided against it, he shared, after talking to peers at another college. The other college had tried the same tactic and saw a reduction in applications and a lower yield rate1 the next year. He speculated that the announcing a lower cost of tuition scared off some students (probably parents, more likely) who took that as a sign that something was wrong at the college or perhaps the quality of the education had gone down. I still vividly recall him shrugging and noting that reductions in tuition were unlikely to ever be widespread, even as the voices raising concerns about college costs get louder and louder, because “nobody wants to be the Wal-Mart of higher education”.

What that president and his college decided to do was to follow the path of many other small to medium sized private colleges and increase their tuition discounting rate.

What is tuition discounting?

According to the National Association of College and University Business Officers (NACUBO), tuition discounting is “a key way independent colleges and universities make education affordable for students - many of whom are paying significantly less than their school’s published prices”.

In the past, I’ve jokingly referred to tuition discounting as the “Kohl’s cash of higher education” and, honestly, I stand by that. Just as nobody ever pays full price for anything at Kohl’s, there are institutions where there are truly no students who are paying the actual sticker price for their education. As the president I interviewed stated “nobody here pays the sticker price, which is the same as nearly all our peer institutions.”

For these schools, their institutional budgets are designed around the idea that all or nearly all of their students will be getting some sort of institutional aid, whether it is called an achievement or merit award, a need based grant, or some other title. It’s important to note that when we talk about “tuition discounting” we aren’t talking about federal or state financial aid programs, only about awards that are funded by the school (in the form of foregone revenue), their endowment, or their foundations.

Another key thing to note is that the tuition discounts are often significant in size. According to NACUBO, the average size of a tuition discount is 56.2% and has been getting larger every year since 2013-2014.

At the schools that do tuition discounting, over 90% of first year students are getting institutional aid:

Which kinds of schools do tuition discounting?

I should note here that while “tuition discounting” is a widely used and understood term in higher education circles, you are unlikely to find a college or university talking openly with prospective students or families about their tuition discount rate. They’ll talk instead about their “generous financial aid options” or “robust scholarship programs” because they understand that there is some psychology at play here. Students and their parents feel excited to see a scholarship or institutional award on their financial aid letter and take that as a sign that the college is uniquely interested in their child. And it isn’t that the college isn’t interested in that applicant, of course, just that everyone in their applicant pool is getting some sort of a discount.

The tuition discount is, at the heart, a tool used to persuade students to enroll in that institution. The schools that are most likely to have a financial model that includes tuition discounting are non-highly selective private colleges. Highly selective institutions do provide institutional aid, but with much smaller percentages of students receiving awards. This is, frankly, because while they have the financial resources to award all students (they are, uh, well endowed, as they say), they don’t need to in order to be competitive for applicants or to improve their yield rates.

Public institutions also don’t engage in tuition discounting, as they get additional financial supports from their states that help support the cost of educating their residents. They also, generally, have some institutional awards but they tend to be narrowly targeted scholarships or need based awards that most students don’t receive.

As an example, let’s look at three institutions2 in the same state:

Highly selective private: Boston University

Less than 15% of applicants admitted and 47% of students got institutional aid (the bulk of the awards went to students from families with incomes below $75,000)

Average institutional award $48,974 or 61% of cost of attendance; cost after institutional aid $30,632, cost without award $79,6063

Public 4-year: Bridgewater State

88% of applicants admitted and 54% of students got institutional aid

Average award $3,851 or 13% of the cost of in-state cost of attendance; cost after institutional aid $24,813, cost without award $28,664

Less selective private: Assumption University

82% of applicants admitted and 100% got institutional aid

Average award $29,654 or 47% of cost of attendance; cost after tuition discount: $33,144, sticker price $62,768

A hypothetical middle income student who got accepted to all three institutions would potentially see their biggest “scholarship” coming from Assumption University but their lowest cost option would still be the public institution, even without getting any institutional aid.

For some families however, the prospect of getting a “scholarship” of $29,000 feels powerful enough to make the higher priced institution more appealing than the lower cost option. There is a psychology to getting such a big discount that can be surprisingly effective as a recruitment tool.

(Side note: things like size, location, and campus fit are also powerful. But it’s also not uncommon to see families making choices that might not make the most sense from a purely financial standpoint. This isn’t a judgment - people are inherently non-rational actors when it comes to money in lots of ways and college is more than just a financial transaction)

Is there a downside to tuition discounting?

In the simplest terms, tuition discounting helps lower the cost of college for students at private colleges, which seems like a good thing. But there are two primary arguments against tuition discounting:

Because some (most?) prospective students don’t know much about this practice, there are some students (especially first generation students) who’ll see the sticker price of a college or university and assume that it will be financially out-of-reach and that college is going to be too expensive for them and may opt not to apply to some schools that could be a good fit for them.

Tuition discounting artificially inflates the sticker price of higher education and once colleges start increasing costs, they don’t come back down, even if a school starts pulling back on their tuition discount rates (something that happens if a school starts to become more selective)

I would also argue that tuition discounting also adds to the challenges of parents and students being able to correctly determine if a college is affordable for them prior to application and admissions.

That being said, I understand why the colleges that engage in this practice do it, given that there continues to be a pervasive belief among many families that more expensive colleges offer a higher quality education4.

For what it’s worth, I don’t believe that cost alone is an indicator of educational quality, nor do I believe that tuition discounting is a sign that a college or university isn’t a high quality institution. There are terrific schools that provide great opportunities for students that are in the tuition discounting game. It’s more of a reflection of the sector of higher ed that they occupy than anything else.

So, how do we know which colleges might be tuition discounting?

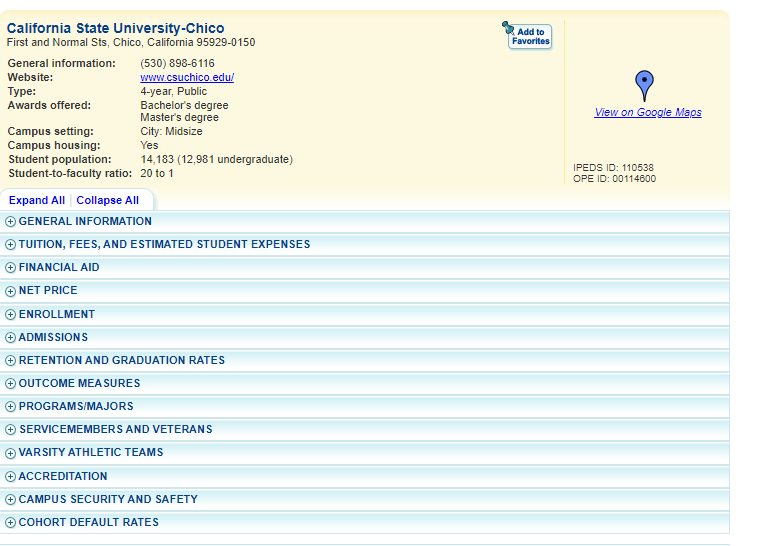

Although their data is usually a year or two out of date (because it takes a while for all the data to come in and get updated), the National Center for Educational Statistics College Navigator tool can be a helpful way to find out how many students at a given institution are getting institutional aid. Simply enter the name of the college and open the financial aid tab to see the institutional aid figure

One final note: some institutions will offer larger discounts for the freshman year than the subsequent years, so when reviewing aid offers it’s always a good idea to double check if any institutional awards (grants or scholarships) are renewable or just for the first year.

Yield rate is the percentage of admitted students who choose to enroll at that college. Colleges want the highest yield rates possible, especially those that are trying to become more selective or to climb the bullshit ranking lists (here is where I issue my standard disclaimer that all the writing here reflects only me and my opinions and research and not those of my current, former, or future employers)

Again, I’m making no argument about quality of institutions here, just sharing some examples representative of their sectors

These are 2021-2022 figures BU is now in the $90K plus club for cost of attendance

Interestingly, there is some research that finds this isn’t universally true and that the relationship between cost and quality of education is “minimal”. There is also some research that indicates students who attend higher cost colleges may have higher incomes following graduation but it can be hard to know if that is a reflection of the quality of education or the social advantages that students attending more selective institutions enjoy.