How to Compare Financial Aid Awards Offers

A practical guide to weighing the costs when choosing a college

When it comes to navigating the college admissions process and making a college choice, there are two letters that probably matter more than any other. The first is, of course, the admissions letter that breaks the good news that a student has been accepted. The second, sometimes even more important letter, will start hitting inboxes/mailboxes soon.

Yep, it’s almost financial aid offer letter season!

(Please note that I’m using “letter” here because I am old and that the actual communication might come via email or student portal notification)

In a perfect world, families would get all their offer letters at the same time (and in roughly the same format) so they could easily review them and make some “apples to apples” comparisons to see which school or schools are the most financially doable for their kid.

In the real world, however, sometimes it takes a little work to make sure you have a clear sense of how the award offers from each school compare and what the actual, final out-of-pocket cost will be after aid is applied.

The good news is that you don’t have to be a math or econ major to figure this stuff out! All you really need is a calculator, a simple spreadsheet, and an understanding of some of the key words and questions to ask.

Before we dive in to how to compare offers, there are a couple of key points to know:

Some schools will call it a financial aid estimate letter, some will call it a financial aid offer letter, but they are generally all going to give you the same information. The letter should detail the available federal, state, and institutional aid available based on information from the FAFSA (and/or state financial aid applications or CSS form, if applicable) for your family as well as the expected tuition and fee costs for the next year1

The letters will generally include information about available federal student loans. This doesn’t mean that the student has to take those loans out if they don’t want them. Loans have to be accepted by the student first (which is why some schools use the “offer” language, since the aid has to be accepted to be applied). The letter should include information about next steps, including how accept the aid offered or decline aid that is unwanted.

The financial aid letter may not include information about private scholarships (i.e. scholarships a student may have been awarded from somewhere other than the institution, such as a private foundation, church, community organization, etc) the student might have been awarded, if that scholarship hasn’t been reported to the institution yet.

Students must reapply for financial aid every year, so this letter will be applicable for the first year of enrollment only. It will generally show the aid equally divided into fall and spring semesters, as shown by the example below, as the assumption is that the student will enroll for the full academic year.

How to Review a Financial Aid Offer

For most families, the biggest question that they want the financial aid letter to answer is “after financial aid is applied, how big will our bill be?” (with the follow up question of “and can we make that work?”). This is a simple question that sometimes leads to the first slightly confusing part of comparing financial aid letters.

Most schools will include a “cost of attendance” summary on their financial aid letter, which may look something like this example from Iowa State University

What’s important to note is that the cost of attendance is NOT the same thing as the actual billed costs from the school. Generally, a student’s billed costs are the tuition & fees plus food & housing (for those living on-campus). The costs listed for things like books & supplies, transportation, and personal expenses are estimates and not something that a student will be billed directly for by the school. The personal expenses category, for example, is meant to include things like clothing, toiletries, and entertainment that a student may purchase over the course of the school year and that they’ll have to spend no matter where they go to school.

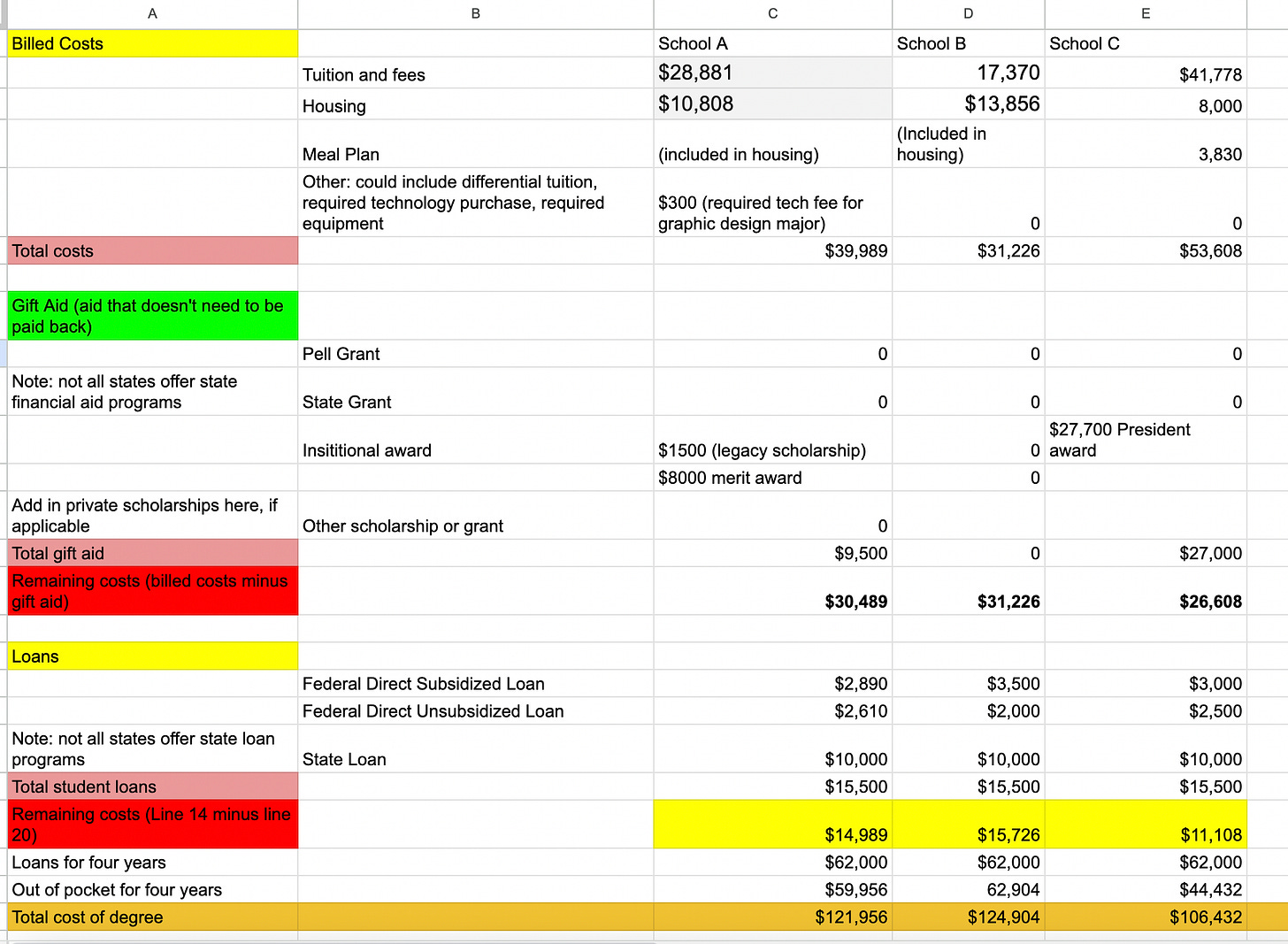

Because those costs aren’t actually billed by the school, and are mostly incremental spending that is spread over the course of the semester, I don’t like to use cost of attendance as the starting point for looking at financial aid offers. Instead, I suggest using billed expenses as the starting point for comparison, as you can see in this spreadsheet example below:

The image above is the starting point of the spreadsheets I use when I work with families and you can tell that it isn’t particularly fancy (graphic design is NOT my passion) but it can be useful to get closer to an “apples to apples” bottom line comparison in line 21.

A few notes about the spreadsheet:

You may not have something to enter in each line for all the schools and that’s okay! Line 5, for example, might be blank for a lot of students if they aren’t in a major or program that charges differential tuition or has required equipment2 to purchase

You may note that I don’t have a spot here for work-study awards. That is on purpose. Work-study is money available to help fund the student if they get an on-campus job, but the student won’t get that money if they aren’t working on-campus and that money is generally paid out to the student as a paycheck rather than being applied to their tuition bill. I think work-study jobs are great, but I don’t think it’s smart to include the money in the calculation because it isn’t guaranteed (the student might not find a campus job they want to do, they might not work enough hours to get the full amount they are eligible for, etc…)

You’ll also note that I don’t show Parent Plus Loans or private loans in the snapshot of the spreadsheet above. For me, those are the loans of last resort, so those would be added if the dollar amount in line 22 isn’t something the family can meet with their available resources (cash in hand, 529 plan funds, etc). You can add those in to the spreadsheet in the loan section if you are planning to use those kinds of loans.

Here’s a lightly redacted version of a completed form I made for a family last year, so you can see what it might look like when it is done:

(For context, this is a family with an income above $100K per year with assets above $75,000, so not considered to have significant financial need. The student had a strong unweighted GPA and average ACT scores. School A was an out-of-state public university, School B was an in-state flagship public university, and School C was an in-state private college)

One disclaimer about the “total cost of degree” line: this is almost certainly not what that actual total cost of degree will be, as tuition and fees will likely increase over four years and housing costs will vary if a student moves off campus. I give parents that disclaimer, but still include it so they can get a sense of how big the price difference between the schools really is and can determine if a total price difference of $3000 is a deal breaker between schools A and B, for example.

Other Questions to Consider

As families review their financial aid offers, there are a few other questions they should make sure to consider to make sure they really understand how the costs might vary over the next few years:

For any institutional awards:

Is the award renewable? If so, what are the renewal criteria?

Minimum GPA?

Total years available (will it cover a 5th year if needed?)

Is it tied to a particular major?

Will the award cover summer enrollment or just fall and spring?

For housing:

Is on-campus housing required? If so, for how many years?

Is on-campus housing guaranteed? If so, for how many years?

Are there lower cost residence halls available?

Are there lower cost food plans available?

Are there other costs not included in the spreadsheet?

On-campus parking if the student is bringing a car

Greek life fees if a student is going to rush

Fee-for-service programs (for example, programs to provide supplemental support students with learning disabilities)

What are the options for payment plans?

Are there monthly payment plans available?

Are there fees for using a payment plan?

Is there a minimum lump sum payment that must be made first?

Can You Negotiate Your Financial Aid Offer?

If you spend much time online in parent forums about college admissions or financial aid, you’ll almost certainly see discussion about whether or not you can negotiate with the college for more financial aid.

(You may also see a decline in your mental health because HOLY CRAP those parent forums can a be a hotbed of bad advice and unchecked parental anxiety. They are kind of the opposite of what I hope this site is, actually.)

The short answer to that question is: maybe?

The long answer will be in my next post, so please feel free to drop any questions you might have about that process in the comments and I’ll be happy to cover it!

A final note: please feel free to share this post with other parents if you find it helpful! I’m always happy to have posts shared or to answer questions in the comments.

Sometimes the tuition and fee costs may be estimated if a school hasn’t set their final tuition for the next year yet.

Programs like nursing, culinary arts, auto mechanics may require students to purchase specific kits/knives/tools needed to do the work in the class and that the student will keep after graduation

This is not part of the financial aid letter, but don't forget to consider the added costs if your student goes to school in another state. Will you be able to drive or will it need to be a plane ticket every time? If you're flying, you'll need to rent a car while you're there, and get a hotel room. A weekend visit to your kid ends up to be a couple thousand dollars. It IS cheaper overall to fly the kid home instead but still several hundred for every school break.